USEPA Issues Expected Rule Designating PFAS as CERCLA Hazardous Substance

What It Means for Environmental Due Diligence of Commercial Real Estate The U.S. Environmental Protection Agency (EPA) announced the pending publication…

What is in and around a building? Find the location-based answers you need with our attribute-rich building data, linked to LightBox address and SmartParcel data.

Request A Demo

Explore nationwide coverage of building shapes greater than 250 square feet for more than 99% of the US population.

Connect with parcel/assessor data (SmartParcels®), as well as address data (SmartFabric).

Gain insights to precise rooftop-level location, as well as primary and secondary addresses, building height, ground elevation and more.

Choose from bulk data, real-time API, or LandVision™ for how you’d like to consume data.

Our LightBox BuildingFootPrintUSA® Addresses product joins building footprint polygons with all known address information for each feature. We provide the best address information possible, for simple single family home, multi-unit dwellings or large office buildings with multiple secondary units, and address information from multiple streets.

We estimate that there are 140m-170m building footprints in the US. Building footprints or their derivatives will displace 75% of address point and parcel boundary usage as the primary ingredient for locating, analyzing and visualizing address information.

Addresses are used to:

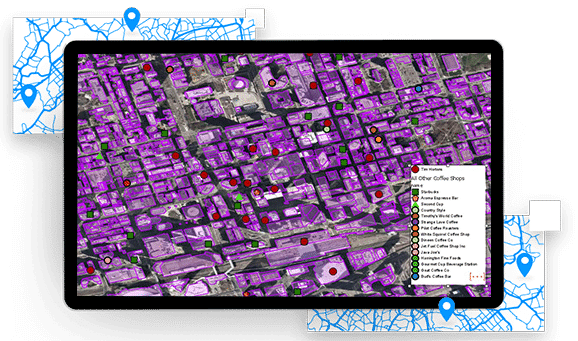

Many of your business problems probably require you to understand what a building looks like, or what its key statistics are.

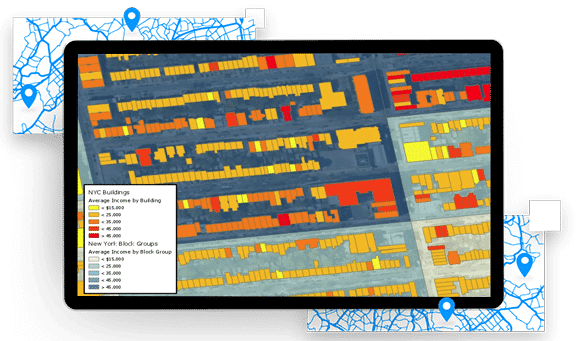

Building height is the basic building block when you want to visualize or analyze information in 3D. Viewsheds, line of sight, wireless signal propagation, urban planning — all require the ability to understand the height of buildings. We are adding building height attribution to millions of buildings with each of our releases.

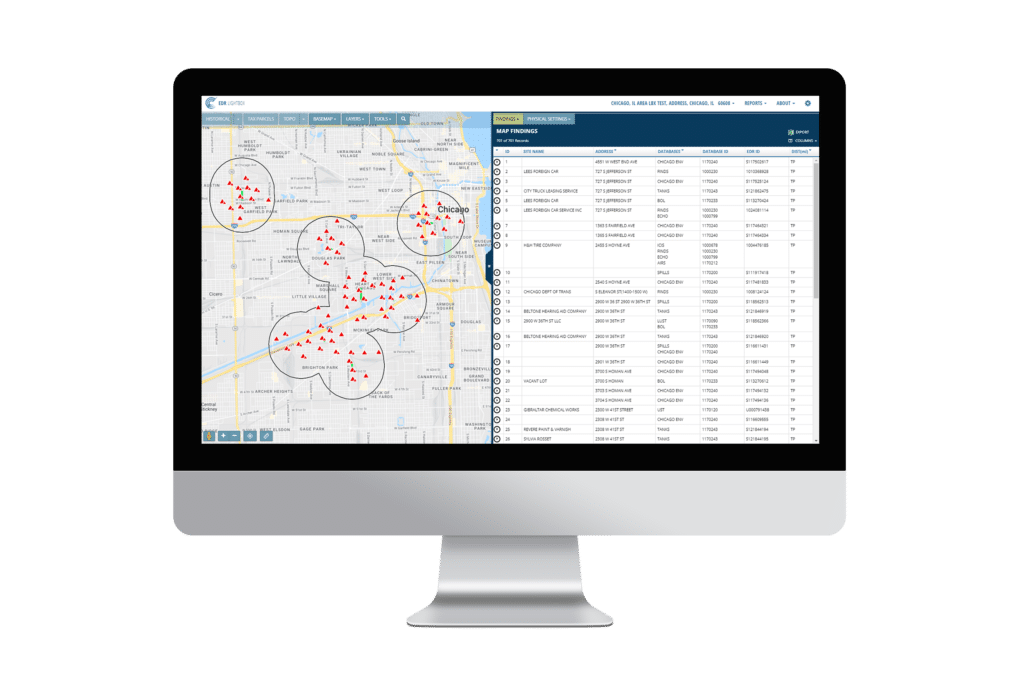

Through any of this analysis, you may want to understand two things. First, what are the individual businesses at a location and what are their characteristics? Second, what can be said about the building based on all of the businesses that are within the building?

We listen to your needs and curate building footprint and business data solutions that solve your business problems.

Your business problems may require you to understand people — individuals, households, concentrations of people in one building. You may need to understand the characteristics of the people — their demographics. Or you may need to understand the buildings that they live in.

Choose from a number of categories of data that can make up a solution:

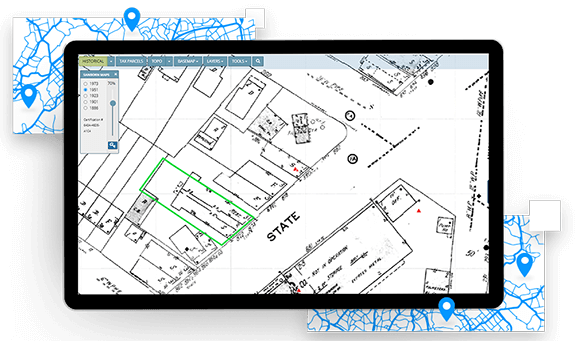

Environmental Due Diligence

Environmental Due Diligence What It Means for Environmental Due Diligence of Commercial Real Estate The U.S. Environmental Protection Agency (EPA) announced the pending publication…

Data

Data Telecommunication providers will heavily depend on geolocation data to expand their networks, reach underserved areas and combat cyberattacks. This insight comes…

Data

Data As the exponential growth of digital businesses and AI continues to surge, the landscape of data centers is shifting. New markets…

Fill out the form below and a member of our Sales Team will contact you shortly.